Three years after its purchase one of Karas buildings has a book value of 400000 and a tax basis of 300000. Three years after its purchase one of Karas buildings has a book value of.

Solved Kara Fashions Uses Straight Line Depreciation For Chegg Com

Kara Fashions uses straight-line depreciation for financial statement reporting and MACRS for income tax reporting.

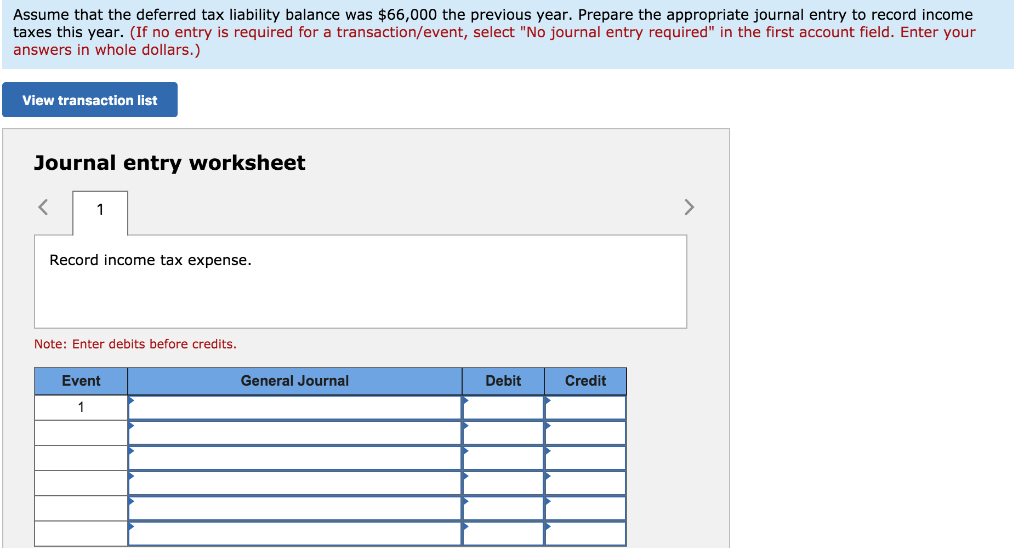

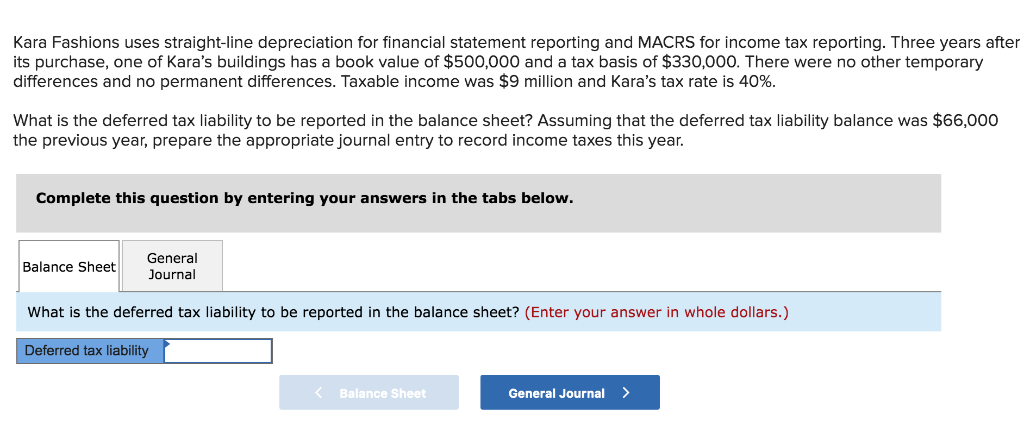

. There were no other temporary differences and no permanent differences. There were no other temporary differences and no permanent differences. Kara Fashions uses straight-line depreciation for financial statement reporting and MACRS for income tax reporting.

Kara Fashions uses straight-line depreciation for financial statement reporting and MACRS for income tax reporting. Three years after its purchase one of Karas buildings has a book value of 1040000 and a tax basis of 780000. Three years after its purchase one of Karas buildings has a book value of 400000 and a tax basis of 300000.

20 out of 2000 points Brief Exercise 16-2 Temporary difference. Kara Fashions uses straight-line depreciation for financial statement reporting and MACRS for income tax reporting. Determine prior year deferred tax amount LO16-1 Kara Fashions uses straight-line depreciation for financial statement reporting and MACRS for income tax reporting.

Three years after its purchase one of Karas buildings has a book value of 400000 and a tax basis of 300000. Kara Fashions uses straight-line depreciation for financial statement reporting and MACRS for income tax reporting. Week 1 Homework - Chapter 16 BE 162 Temporary difference.

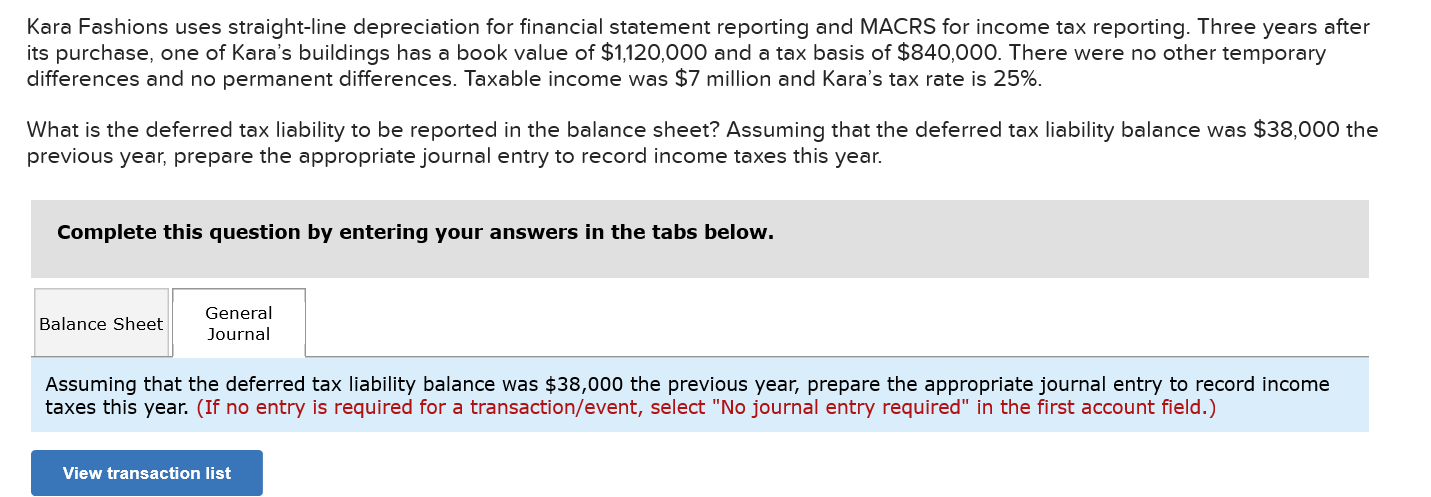

Three years after its purchase one of Karas buildings has a book value of 840000 and a tax basis of 630000. There were no other temporary differences and no permanent differences. There were no other temporary differences and no permanent differences.

There were no other temporary differences and no permanent differences. Three years after its purchase one of Karas buildings has a book value of 400000 and a tax basis of 300000. Save you a lot of time and get you an A easily Question 1 Kara Fashions uses straight-line depreciation for financial statement reporting and MACRS for income tax reporting.

Three years after its purchase one of Karas buildings has a carrying value of 400000 and a tax basis of 300000. Kara Fashions uses straight-line depreciation for financial statement reporting and MACRS for income tax reporting. Taxable income was 6 million and Karas tax rate is 35.

1 Kara Fashions uses straight-line depreciation for financial statement reporting and MACRS for income tax reporting. Three years after its purchase one of Karas buildings has a carrying value of 400000 and a tax basis of 300000. Kara Fashions uses straight-line depreciation for financial statement reporting and MACRS for income tax reporting.

Kara Fashions uses straight-line depreciation for financial statement reporting and MACRS for income tax reporting. There were no other temporary differences and no permanent differences. There were no other temporary differences and no permanent differences.

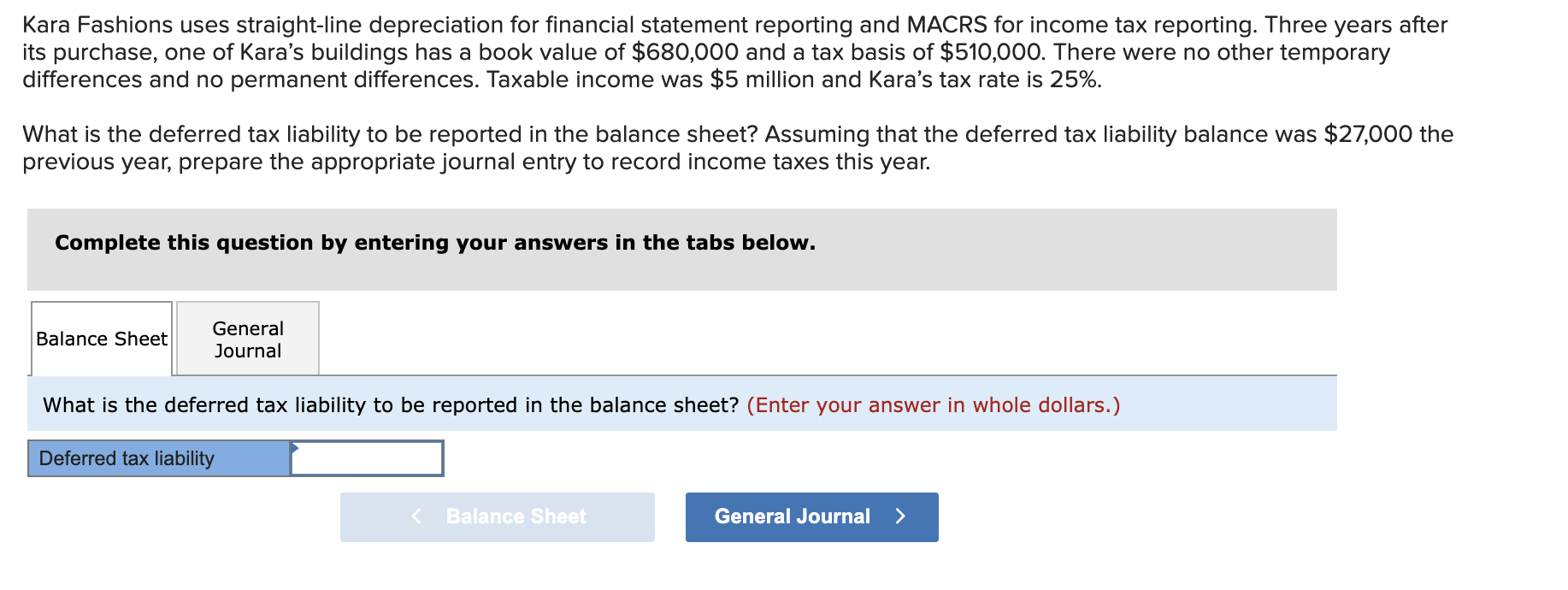

Determine deferred tax amount LO162 Kara Fashions uses straight-line depreciation for financial statement reporting and MACRS for income tax reporting. Three years after its purchase one of Karas buildings has a book value of 680000 and a tax basis of 510000. Determine prior year deferred tax amount LO16-1 Kara Fashions uses straight-line depreciation for financial statement reporting and MACRS for income tax reporting.

Kara Fashions uses straight-line depreciation for financial statement reporting and MACRS for income tax reporting. Three years after its purchase one of Karas buildings has a book value of 470000 and a tax basis of 320000. Taxable income was 4 million and Karas tax rate is 25.

Kara Fashions uses straight-line depreciation for financial statement reporting and MACRS for Kara Fashions uses straight-line depreciation for financial statement reporting and MACRS for income tax reporting. There were no other temporary differences and no permanent differences. Kara Fashions uses straight-line depreciation for financial statement reporting and MACRS for income tax reporting.

Three years after its purchase one of Karas buildings has a carrying value of 390000 and a tax basis of 260000. Three years after its purchase one of Karas buildings has a book value of 400000 and a tax basis of 300000. There were no other temporary differences and no permanent differences.

Kara Fashions uses straight-line depreciation for financial statement reporting and MACRS for income tax reporting. Three years after its purchase one of Karas buildings has a book value of 1000000 and a tax basis of 750000. Three years after its purchase one of Karas buildings has a book value of.

There were no other temporary differences and no permanent differences. Three years after its purchase one of Karas buildings has a carrying value of 450000 and a tax basis of 315000. There were no other temporary differences and no permanent differences.

There were no other temporary differences and no permanent differences. Three years after its purchase one of Karas buildings has a book value of 400000 and a tax basis of 300000. Three years after its purchase one of Karas buildings has a carrying value of 400000 and a tax basis of 300000.

Three years after its purchase one of Karas buildings has a book value of 400000 and a tax basis of 300000. There were no other temporary differences and no permanent differences. Week 2 Chapter 16 Homework 1.

Kara Fashions uses straight-line depreciation for financial statement reporting and MACRS for income tax reporting. There were no other temporary differences and no permanent differences. Kara Fashions uses straight-line depreciation for financial statement reporting and MACRS for income tax reporting.

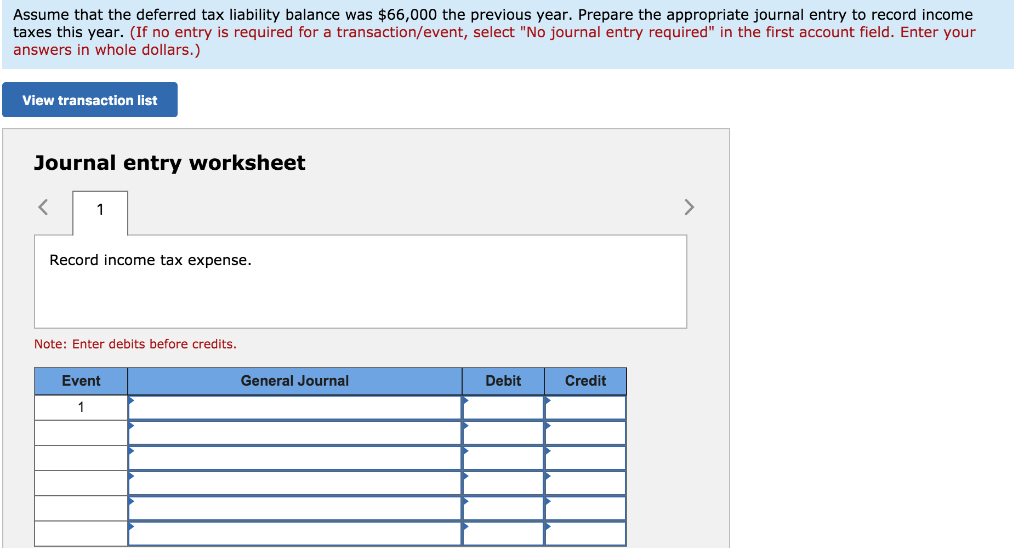

Brief Exercise 16-2 Temporary difference.

Kara Fashions Uses Straight Line Depreciation For Financial Statement Reporting And Macrs For Income Tax Reporting Three Homeworklib

Kara Fashions Uses Straight Line Depreciation For Financial Statement Reporting And Macrs For Income Tax Reporting Three Homeworklib

Kara Fashions Uses Straight Line Depreciation For Financial Statement Reporting And Macrs For Income Brainly Com

Solved Kara Fashions Uses Straight Line Depreciation For Chegg Com

Solved Kara Fashions Uses Straight Line Depreciation For Chegg Com

Ch 16 2 Hw Docx Kara Fashions Uses Straight Line Depreciation For Financial Statement Reporting And Macrs For Income Tax Reporting Three Years Course Hero

Solved Kara Fashions Uses Straight Line Depreciation For Chegg Com

Solved Kara Fashions Uses Straight Line Depreciation For Chegg Com

0 comments

Post a Comment